Ningbo Yinzhou Leisheng Machinery Co.,Ltd , https://www.nblscasting.com In 2012, the country began to implement a trial of the change of business tax to value-added tax (hereinafter referred to as “Zhan Gai Zengâ€), which included the transportation industry and some modern service industries in the scope of this pilot. The main considerations in selecting pilot projects for the transportation industry are one: the transportation industry is closely linked with production and circulation, and plays an important role in the producer service industry; second, transport costs are within the scope of current VAT input tax credits, and freight invoices have been included in VAT. The management system has a good foundation for reform. One of the major considerations in selecting some modern service industry pilots is that the modern service industry is an important indicator of a country’s economic and social development. Supporting its development through reforms is conducive to the promotion of the country’s overall strength; the second is selecting modern services that are closely related to the manufacturing industry. Trials in the industry can reduce the repetitive taxation factors existing in the refinement of the industrial division of labor, which is conducive to the development of the modern service industry and to the upgrading of the manufacturing industry and technological progress.

In 2012, the country began to implement a trial of the change of business tax to value-added tax (hereinafter referred to as “Zhan Gai Zengâ€), which included the transportation industry and some modern service industries in the scope of this pilot. The main considerations in selecting pilot projects for the transportation industry are one: the transportation industry is closely linked with production and circulation, and plays an important role in the producer service industry; second, transport costs are within the scope of current VAT input tax credits, and freight invoices have been included in VAT. The management system has a good foundation for reform. One of the major considerations in selecting some modern service industry pilots is that the modern service industry is an important indicator of a country’s economic and social development. Supporting its development through reforms is conducive to the promotion of the country’s overall strength; the second is selecting modern services that are closely related to the manufacturing industry. Trials in the industry can reduce the repetitive taxation factors existing in the refinement of the industrial division of labor, which is conducive to the development of the modern service industry and to the upgrading of the manufacturing industry and technological progress.

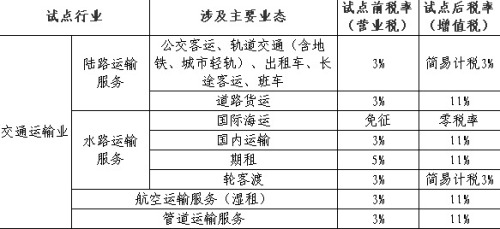

For the general taxpayer, the current "reform by business tax reform" pilot will be based on the existing 17% VAT tax rate and 13% low tax rate, adding 11% and 6% of the two low tax rates, 11% of the transportation industry Tax rates, some modern service industries apply a tax rate of 6%. Small-scale taxpayers adopt a simple 3% levy rate; the changes in the tax rate before and after the general taxpayer in the sub-sectors of the transport industry change as follows: According to the pilot scheme, the “previous business tax incentives granted by the state to pilot industries can be extendedâ€. The principle of the current "Camp Reinforcement Increase" related policy clarifies the continuation of the original preferential business tax policy involving some pilot areas and pilot taxable services. One is to implement the VAT rebate policy for domestic cargo transportation, warehousing and loading and unloading services provided by pilot taxpayers registered in the Yangshan Bonded Port Area, and the second is for taxpayers registered in Tianjin Dongjiang Bonded Port Area. The domestic cargo transportation, warehousing and loading and unloading and transportation services implement the VAT rebate policy; the third is from the date of implementation of the pilot project in the region until December 31, 2013, pilot taxpayers registered in service outsourcing model cities in China are engaged in offshore The taxable services provided in the service outsourcing business are exempt from value-added tax; the taxable services provided in pilot offshore taxpayers registered in Pingtan are exempt from value-added tax.

The international transportation services provided by units and individuals within the territory of the People's Republic of China (hereinafter referred to as the territory) apply the zero rate of value-added tax; the domestic units and individuals provide transportation services to and from Hong Kong, Macau, and Taiwan and provide services in Hong Kong, Macau and Taiwan. The transportation service is applicable to the zero rate of VAT. Public transport services provided by general taxpayers in pilot taxpayers can choose to calculate VAT payable according to the simplified tax calculation method. Public transport services include wheel passenger ferries, bus passenger transport, rail transit (including subways, urban light rail), taxis, long-distance passenger transport, and shuttle buses. Among them, the shuttle bus refers to the land transportation of transporting passengers that operates on a fixed route and at a fixed time and stops at a fixed site. The general taxpayers in the pilot taxpayers may use the simple tax calculation method to calculate and pay value-added tax during the pilot period, provided that the commercial lease service provided by the tangible movable property acquired or self-made before the pilot date of the pilot project in the area is provided.

In order to do a good job in the trial of "transformation reform and increase" in the transportation industry and some modern service industries throughout the country, the state finance and taxation department issued the "Notice on the Taxation Policy on the Implementation of the Business Tax for the Renovation of Value Added Tax (VAT) in the Transport Industry and Some Modern Service Industries across the Country. (Fiscal and Taxation (2013) No. 37) (hereinafter referred to as the “Noticeâ€), the current pilot policy has been consolidated and adjusted. The policy adjustments related to the transportation industry mainly include:

First, after cancelling part of the differential taxation policy and pushing the “business-to-business reform†across the country, the taxation policy for the taxation of the taxation of duplicated businesses between taxpayers in the same industry has been passed by the VAT deduction mechanism. Instead, the "Notice" cancelled the taxation policy for taxpayers providing transportation services, warehousing services, and international freight forwarding agents.

The second is to cancel the policy of calculating input tax based on transport cost settlement documents. Taking into account that the method of calculating input tax based on transportation cost settlement bills, etc., is essentially a kind of virtual deduction policy. There are also large loopholes in the implementation, and the transportation industry will provide transportation after the implementation of “campaign increase†in the country. Taxpayers of transport services may issue special VAT invoices without extending the above-mentioned virtual deduction policy. Therefore, the "Notice" canceled the pilot taxpayer and the original VAT payer, and calculated the input tax according to the amount of transportation and freight settlement fee and the 7% deduction rate; canceled pilot taxpayers to accept pilot small-scale taxpayers to provide transportation For transport services, the input tax is calculated based on the amount specified in the VAT invoice and the 7% deduction rate.

The third is to cancel the policy of permitting units and individuals that have not entered into a bilateral transport tax exemption arrangement with China to temporarily deduct and pay VAT at a rate of 3%. These units and individuals should withhold the applicable tax rate for providing taxable services. VAT paid.

Fourth, the policy of disallowing pilot taxpayers and original VAT payers to deduct their input taxes on self-used consumption tax motorcycles, automobiles, and yachts.

Fifth, when the pilot taxpayers provide services to the public, both the VAT exemption and the VAT zero tax rate are applicable, the “Notice†clarifies the priority to apply the zero tax rate.

Transport business tax reform to increase value-added tax